Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

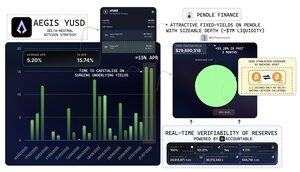

ICYMI @aegis_im's sYUSD has quietly been outperforming w/ underlying yields consistently >15% over the past 2 weeks.

This is a clear strength of DN strategies where they thrive in volatile markets.

And with volatility picking up lately, sYUSD is doing exactly what it’s designed for.

Crucially, all of this is underpinned by institutional-grade custody + real-time reserve verifiability (powered by @AccountableData) offering high levels of transparency.

Capturing yield is one thing.

But locking it in structurally is where the real edge lies.

That’s where @pendle_fi comes in:

sYUSD’s PTs on Pendle offer scalable fixed yields with $7M+ in liquidity at 16.47% implied APY (realistic sizing w/ minimal implied yield slippage)

Chads have been striking while the iron’s hot by locking in dem juicyy yields.

4,88K

Johtavat

Rankkaus

Suosikit