Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jurrien Timmer

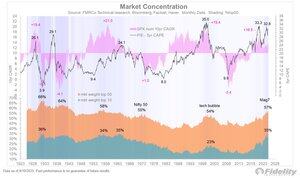

Looking at the S&P 500 equal-weighted index, we see a market that sits right on its rising trendline (just short of making new highs), with about two-thirds of the market above their moving average. Meanwhile the equal-weighted forward P/E ratio of 18.3x is a smidge above its average of 17x. Looking at this chart, I do not see a market that is over its skis.

1,73K

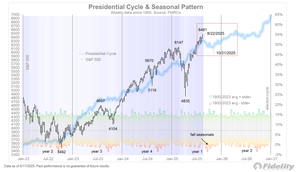

Another week, and another new high for most equity indices. The S&P 500 cap-weighted index now sits at 6481, which is quite a feat considering it traded at 4835 just a few months ago. The glass seems to be mostly full these days, with investors embracing the animal spirits of fiscal expansion and soon monetary accommodation, while looking past the tariff question for now. The Mag 7 continues to power this train, leaving the rest of the market in OK shape.

12,42K

Looking at the S&P 500 equal-weighted index, we see a market that sits right on its rising trendline (just short of making new highs), with about two-thirds of the market above their moving average. Meanwhile the equal-weighted forward P/E ratio of 18.3x is a smidge above its average of 17x. Looking at this chart, I do not see a market that is over its skis.

18,58K

With the Fed now fully expected to ease in September, the bigger news will be to what extend Chair Powell’s remaining months at the helm of the Fed might be overshadowed by the next Chair, and to what degree their directives might be at odds. At least for now the main difference will presumably be the speed and magnitude of rate cuts, rather than the direction of policy.

Support for rate cuts seems to stem from weakness in the labor market, although from my non-economist angle I don’t see any. The JOLTS report, Weekly Economic Index, and jobless claims, all point to an economy in balance from where I am sitting. It suggests a neutral Fed policy, which in my view should be around 3.75%.

16,25K

There is no question that we have been in a secular bull market for many years (since 2009 by my count). The question is whether it will eventually end with a whimper or a bang. The 1982-2000 secular bull ended with a loud bang in the form of the bubble, while the 1949-1968 bull ended with a series of modest new highs followed by increasingly large drawdowns. You can see that nuance in the chart below.

So far, the current secular trend seems to be following the 1960’s analog more than the late 1990’s, and the CAPE model suggest that over the next few years the return profile will accelerate before the secular wave crests.

While this secular bull is getting long in the tooth at 16 years old, the analog to both the 1982-2000 and 1949-1968 super-cycles shows that there could be a few more innings left, pushing the market to ever new highs. Per the regression trend lines below the two historical analogs are a very close fit to today’s market.

24,45K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin