Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

YashasEdu

Love to read and write on DeFi and AI | Building @PrismHub_io | Thoughts are my own

So @Lombard_Finance’ $LBTC holder count just hit 269k users & here's why this matters for BTCFi👇

> 90.9% hold small amounts (0-0.001 $LBTC), proving retail adoption

> $1.56B TVL shows significant capital wants Bitcoin earning yield

> Opportunities across @ethereum @base @SuiNetwork @SonicLabs @katana @berachain

> Users earning from loans, liquidity provision & DeFi strategies while keeping Bitcoin exposure

Infra layer approach means $LBTC becomes more useful as BTCFi ecosystem expands.

Stitch17 tuntia sitten

Lombard implements LBTC in Etherlink and Starknet

@Lombard_Finance, a leading developer for bringing BTC into the DeFi ecosystem, continues to develop its product and integrate it into @etherlink and @Starknet

The integration of LBTC in the largest protocols will help create a thriving DeFi ecosystem for BTC, allowing users to utilize BTC more efficiently

LBTC works through staking Babylon at a 1:1 ratio, allowing users to earn income not only from staking but also from DeFi

The Lombard ecosystem is constantly expanding, making BTC easy to use in the DeFi system and turning it into an income-generating tool

Lombard's liquid restaking is already integrated into about 100 of the most popular DeFi projects across different blockchains

2,97K

Over the past month @ethena_labs has been crushing it🔥

> $USDe supply has surged 75% to $9.3B

> $3.1B+ in the last 20 days

> The fastest growing YBS based on TVL (3rd largest stablecoin by mcap)

> DeFi's 6th largest protocol by TVL

> Utilization of @BlackRock BUIDL fund based RWA via $USDtb

> Working with the institution level through @convergeonchain

$106.59M (2.7% of CS) of $ENA is getting unlocked tomorrow.

Tom Wan4.8. klo 03.48

The combined market cap of USDe and USDtb has reached $10B.

Excluding the double count, Ethena still has $9.4B TVL, and will soon become the only 5 DeFi protocols to have $10B+ TVL.

5,49K

19 things that quietly sabotage your life if you keep doing them…

1/ Don't overshare your struggles with random people

2/ Don't announce your goals before you've made real progress

3/ Don't complain about the same problems without taking action

4/ Don't compare your behind the scenes to everyone else's highlight reel on social media

5/ Don't check your phone first thing in the morning

6/ Don't say yes to everything out of fear of disappointing people

7/ Don't argue with people who aren't interested in understanding your perspective

8/ Don't hold grudges against people who don't even remember what they did

9/ Don't spend money you don't have to impress people you don't actually like

10/ Don't ignore small problems hoping they'll disappear

11/ Don't make major decisions when you're emotional

12/ Don't assume people understand what you need without you clearly communicating it

13/ Don't keep toxic people around because you have history together

14/ Don't procrastinate on things that take less than 10 minutes

15/ Don't take criticism from people whose opinions you wouldn't ask for advice

16/ Don't stay in situations that consistently drain your energy without giving anything back

17/ Don't expect others to change just because you want them to

18/ Don't sacrifice your mental health for anyone else's comfort or expectations

19/ Don't wait for the ‘perfect moment’ to start something important

Small habits compound into big life changes, positive or negative.

2,12K

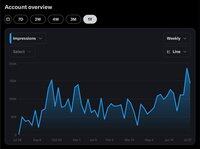

That's what a year of grinding looks like.

This is my Twitter analytics from the past 12 months & honestly, it's been a wild ride that I want to share because I think it'll help anyone building their own audience.

Started from basically nothing last July. Those first few months were brutal.

> Felt like I was posting into the void

> Got a few hundred impressions per tweet

> Wondered if anyone even cared about what I was sharing

But I kept going because I believed the content was valuable.

> Had decent spikes in Sept & Oct

> Nov-Mar was honestly depressing

Impressions dropped to 25k some weeks, engagement felt non existent, & I questioned whether I was wasting my time writing about crypto & DeFi.

Here's what I learned during those low months👇

1/ They weren't wasted time

2/ Every thread taught me something about my audience

3/ Every reply built a relationship that would matter later

4/ Learnt a lot from the posts of @0xCheeezzyyyy @kenodnb @thelearningpill @AlwaysBeenChoze & how they went ahead w their posts

5/ I was building the foundation even when it didn't feel like progress. Connected w some amazing folks like @splinter0n @eli5_defi @Hercules_Defi @0xAndrewMoh

The real change started happening around April & May. Not because I discovered some algorithm hack or viral formula, (see the numbers are not that great) but because I'd finally understood what my audience needed.

Better analysis, clearer explanations, less hype & more data pa. The compound effect slowly now has started kicking in. June & July have been good. But more importantly, the engagement quality is so much higher. People are actually finding value in what I share.

The lesson?

Your breakthrough is probably closer than you think, but it won't look like you expect. It's not one viral tweet that changes everything (for some it does) but I believe it's the slow build of trust, consistency & genuine value creation.

If you're down right now, I promise it's worth pushing through.

Slow audience > Quick audience

2,9K

$AVAIL might be the most undervalued infra play in crypto right now. NFA

> Trading at $63M valuation compared to $1.1B of $TIA & $347M $EIGEN despite comparable development

> Survived $19M token unlock (38% supply) with only 1.2% price drop while others crashed 10-15%

> 100+ partner projects like @sophon @LC @soon_svm already building on their DA infra

> 11%+ staking yields + 1.7M+ blocks processed

> $150M+ in TVS

> Nexus stack (across 9 chains) positioning for tokenization as BlackRock/JP Morgan enters the RWA space

DA demand growing with Ethereum rollup expansion. @AvailProject is building the boring infra that institutions actually need for large scale tokenization.

5,52K

Succinct mainnet & TGE will happen in early August.

@SuccinctLabs’ SP1 zkVM is getting attention as it’s the first 100% next gen open source zkVM with Rust/C++ support.

zkVMs solve Ethereum's scalability by moving computation offchain & only submitting small proofs onchain. Making it way more efficient.

What makes SP1 different?

> Fully open source

> Works with existing dev tools

> Performance competitive with closed systems

Since their testnet they’ve shipped the fastest zkVM.

+ 35+ customers

+ $4B+ TVL secured

+ 5M proofs generated

$PROVE is currently trading around $1 on the whales market.

At current prices $1.1B FDV with 200M CS (20% of 1B total) puts it in Starknet territory for zkVM valuations.

ZK lets you verify without exposing data, perfect for private financial products that banks actually want. All OP rollups might eventually convert to ZK because of better security & no withdrawal delays.

As the first major next gen zkVM TGE, this will become the benchmark for upcoming ZK infra projects.

Uma Roy31.7.2025

We started Succinct when everyone said ZK was too expensive, too slow, and too complex. Since then, we have shipped the fastest zkVM and gotten:

• 35+ customers

• $4B+ TVL secured

• 5M proofs generated

Mainnet imminent. gprove

975

$HOME has a $95M mcap with 10B total supply. This S2 drop is massive relative to their size ($35M worth at current prices)

> DEX aggregator: $12B+ volume ($1.33B since TGE)

> Perp aggregator: $2B+ volume ($1.017B since TGE)

DEX volume slowing down while Perp is growing. Makes sense since that's where the big money flows are moving.

Got $8,000 from their S1 airdrop, so can't complain about their distribution model.

The proposal to buyback 80% shows they're thinking longterm growth.

Worth keeping an eye on @defidotapp for S2 if you're active into trading.

4,93K

Most current infra can't be profitable today, so you're basically betting on future market growth rather than present utility.

The problem?

Everyone's rushing to distribute tokens to holders instead of building sustainable revenue streams.

20/80 rule applies here. 20% of infra projects will capture 80% of demand. The rest become noise.

Tokenomics matter way less than actual PMF. You can have perfect token mechanics, but if there's no real demand for your infra, you're just creating elaborate wealth redistribution schemes.

Projects work because they solved real problems first, then added tokens. Most others do it backwards. Infra I’m betting on👇

L1: @ethereum @solana @HyperliquidX @SeiNetwork @SuiNetwork

Defi x TradFi hubs: @arbitrum @Mantle_Official @katana

Lending: @aave @0xfluid @sparkdotfi @MorphoLabs

RWA: @maplefinance @plumenetwork @OndoFinance @ethena_labs

Yields: @pendle_fi @GammaSwapLabs @SiloFinance

Stablecoin: @ethena_labs @FalconStable @ResolvLabs

AI: @Mira_Network @AlloraNetwork @nillionnetwork @campnetworkxyz

ZK: @SuccinctLabs @boundless_xyz @union_build

DePin: @peaq @BeamableNetwork @ionet

BTCFi: @babylonlabs_io @Stacks @satlayer

Oracles: @chainlink @redstone_defi

The infra boom feels similar to the L1/L2 race. Lots of builders, limited winners & the market will eventually consolidate around whoever provides genuine utility at scale.

45,39K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin