Trend-Themen

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

GM,

$ETH erreichte $4.300 und die Spieltheorie, über die ich vor Monaten gesprochen habe, spielt sich immer noch genau wie erwartet ab.

Als Unternehmen wie SharpLink Gaming, Bitmine Immersion Tech, Coinbase und sogar ETFs begannen, ETH-Reserven aufzubauen, war das nicht nur "bullische Akkumulation".

Es war strategisches Signalisieren.

ETFs fügen weiterhin hinzu und reduzieren das verfügbare Angebot. Und je höher der Preis steigt, desto stärker wird das institutionelle FOMO.

So bewegte sich Bitcoin genau vor seinen parabolischen Läufen.

Und meiner Meinung nach wird die nächste Phase für ETH schneller voranschreiten, als die meisten erwarten.

Schönes Wochenende.

23. Juli 2025

GM bulls,

I’ve been thinking a lot about game theory lately, not in the abstract, but in how it’s quietly playing out across the @ethereum ecosystem.

What I see isn’t just “bullish accumulation.”

It’s strategic signaling.

And the coordination effects are already unfolding.

Let’s look at the data:

▸ SharpLink Gaming now holds 360.8K ETH

▸ Bitmine Immersion Tech follows with 300.7K ETH

▸ Ethereum Foundation sits on 238.5K ETH

▸ Coinbase, Bit Digital, Golem Foundation, all hold 100K+ ETH

▸ And spot ETFs now collectively own 4.8M ETH (still unstaked)

That’s not retail noise. That’s balance-sheet conviction.

When one public company makes ETH a treasury asset, it’s a calculated move.

But when multiple companies do it, something bigger happens:

They trigger a reflexive loop, where each new buyer pressures others to act.

▸ No CFO wants to be the one who “missed ETH” on the balance sheet.

▸ No asset manager wants to be last to rotate into the settlement layer of AI, DeFi, and tokenized assets.

This is classic game theory:

→ First movers benefit from lower prices and long-term narrative alignment

→ Late movers risk relative underperformance, not just in returns, but in strategic positioning

And this dynamic feeds itself:

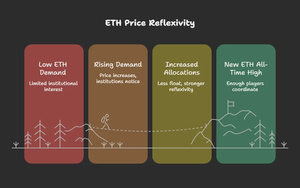

More corporate demand → less liquid float → price appreciation → more headlines → more institutional entry

So when people ask “Can ETH break its ATH again?", I don’t think it’s a question of hype or speculation.

I think it’s a question of coordination threshold, how many players need to act before the price reflex goes vertical.

We’re closer than it seems.

6,08K

Top

Ranking

Favoriten