Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Bitcoin and Ethereum have seen a significant pullback today, with various reasons being speculated.

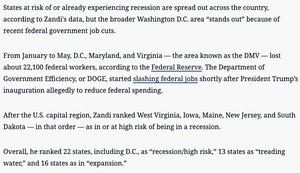

Some say it's due to exchanges dumping, others claim it's because whales are fleeing, some suggest that Nvidia's earnings report this week may not meet expectations, while others point to Trump saying that the cards he holds could "destroy" the Chinese economy. There are also reports from Moody's and some economists stating that the U.S. is on the brink of recession.

Other reasons are unlikely to cause long-term widespread impact, but the recession theory could be elaborated on, as economic signals are numerous and complex.

Personally, I believe that traditional economists may once again overlook the "non-traditional" key factor of the AI revolution, which is reshaping the economic landscape.

If we must discuss recession pressures, a more appropriate description might be: the U.S. economy is currently in a unique period shaped by both cyclical pressures (as indicated by the LEI leading economic index) and structural new dynamics (as indicated by the AI revolution).

The risk of recession does exist and cannot be ignored, but the accelerated development of AI is the decisive factor for the economy.

The current situation resembles a "gear-shifting" phase in an economic structural transformation, rather than a simple cyclical recession.

According to research estimates from major institutions, even under pessimistic expectations, generative AI could trigger a "massive productivity boom in the labor force" within the next one to three years, potentially adding trillions of dollars to global GDP.

The huge investments in AI explain why, despite numerous warning signals, the hard economic data remains resilient.

Similarly, the viewpoint on a stock market crash largely fails to consider the AI factor.

The conclusion is:

There will be growing pains, there will be pullbacks in a bull market, but there will not be a recession, and a bear market is not yet here.

The bull is still here!

70.49K

Top

Ranking

Favorites