Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

GM bulls,

I’ve been thinking a lot about game theory lately, not in the abstract, but in how it’s quietly playing out across the @ethereum ecosystem.

What I see isn’t just “bullish accumulation.”

It’s strategic signaling.

And the coordination effects are already unfolding.

Let’s look at the data:

▸ SharpLink Gaming now holds 360.8K ETH

▸ Bitmine Immersion Tech follows with 300.7K ETH

▸ Ethereum Foundation sits on 238.5K ETH

▸ Coinbase, Bit Digital, Golem Foundation, all hold 100K+ ETH

▸ And spot ETFs now collectively own 4.8M ETH (still unstaked)

That’s not retail noise. That’s balance-sheet conviction.

When one public company makes ETH a treasury asset, it’s a calculated move.

But when multiple companies do it, something bigger happens:

They trigger a reflexive loop, where each new buyer pressures others to act.

▸ No CFO wants to be the one who “missed ETH” on the balance sheet.

▸ No asset manager wants to be last to rotate into the settlement layer of AI, DeFi, and tokenized assets.

This is classic game theory:

→ First movers benefit from lower prices and long-term narrative alignment

→ Late movers risk relative underperformance, not just in returns, but in strategic positioning

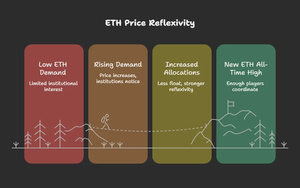

And this dynamic feeds itself:

More corporate demand → less liquid float → price appreciation → more headlines → more institutional entry

So when people ask “Can ETH break its ATH again?", I don’t think it’s a question of hype or speculation.

I think it’s a question of coordination threshold, how many players need to act before the price reflex goes vertical.

We’re closer than it seems.

20.7.2025

$ETH: 3767$

Congrats to everyone who’s been holding and consistently DCA’ing into $ETH.

It hasn’t been easy, but the thesis is starting to play out and the onchain data reflects it.

Right now, about 29.15% of ETH supply is staked, that’s 36M ETH, backed by over 1.1M validators.

Some might see this as a saturated market. I don’t.

To me, this figure still leaves room for structural upside.

▸ Lido holds ~25% market share of all staked ETH

▸ Binance, Coinbase, Kraken remain dominant among CEX stakers

▸ Net staking flow post-Shanghai: +17.8M ETH, a clear directional trend

But there’s an important nuance:

ETH ETFs which now collectively hold ~4.8M ETH are not staking yet.

This isn’t necessarily a flaw. It’s a regulatory constraint, made explicit in their filings.

But if this changes (as we've seen with some Solana funds abroad), it would introduce a new source of passive staking demand.

I’m not saying this will happen tomorrow.

But it’s a scenario worth tracking, one that could shift ETH’s staking ratio significantly over time.

So no, this isn’t a sudden unlock or guaranteed catalyst.

It’s a slow-moving dynamic that reflects how Ethereum’s financial primitives are maturing, across staking, settlement, and yield layers.

I continue to hold and allocate accordingly.

Not out of hype, but because I believe $ETH is becoming something more foundational than just another token:

→ A programmable asset with monetary depth, institutional buy-in, and increasingly, infrastructure-level utility.

7,94K

Johtavat

Rankkaus

Suosikit